Dubai’s real estate market has emerged as one of the most attractive investment destinations, offering promising opportunities for both local and international investors, as well as high-net-worth individuals and first-time homebuyers. Moreover, characterized by its dynamic growth, the market continues to draw attention, providing a lucrative landscape for those seeking diverse investment portfolios. One particular aspect that has gained popularity is the buying of off-plan properties.

In the bustling context of Dubai’s real estate trends in 2024, investors actively favor the strategy of buy off-plan in Dubai. These off-plan projects in Dubai cater to various preferences, reflecting the dynamic nature of the city’s real estate landscape. Overall, the market’s resilience and growth potential highlight the off-plan projects in Dubai.

In this blog, we will delve into the ins and outs of buying an off-plan property in Dubai in 2024 and explore the benefits, risks, and step-by-step process involved. We’ll cover the following topics:

- Understanding Off-Plan Property Investment

- The Real Estate Market in Dubai

- Steps to Buying an Off-Plan Property in Dubai

- The Costs of Buying an Off-Plan Property

- Risks and Challenges of Off-Plan Property Investment

- Making the Most of Your Off-Plan Property Sales and Investment

Understanding Off-Plan Property Investment

Before delving into specifics, it’s essential to define what an off-plan property entails. Essentially, it involves purchasing a property before its completion or even before construction commences. This allows buyers to secure properties at lower prices compared to ready-to-move-in units and potentially enjoy appreciation over the construction period.

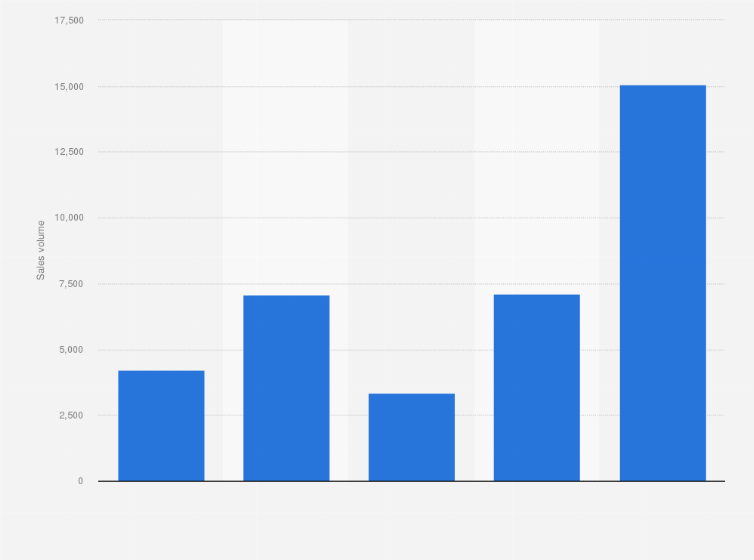

Investing in off-plan properties can be an exciting venture that offers investors a unique opportunity to be part of the development process from the ground up. According to DXB Interact, 61% of Q3 2023 sales volume came through Off-Plan alone. This amounted to AED 13.62 billion!

This stat alone shows the rising popularity of Off-Plan properties. By getting in early, buyers have the chance to witness the project evolve, from the initial stages of construction to the final touches that make a property a home. Taking a hands-on approach can provide a sense of fulfillment and pride in actively participating in creating something from its inception.

So, why should you consider investing in off-plan properties?

Well, there are several compelling reasons to do so. First and foremost, it offers the opportunity to buy at a discounted price. Developers often offer attractive payment plans, enabling buyers to spread the cost over the construction period for off-plan payment plans in Dubai. This allows buyers to manage their finances more effectively and secure their investment. Additionally, these payment plans contribute to the appeal and accessibility of off-plan properties in Dubai.

Secondly, off-plan properties frequently come with modern designs and state-of-the-art amenities. By investing early, buyers can enjoy the advantage of choosing prime units within the development, ensuring a desirable location and potentially higher rental yields or resale value in the future.

The Real Estate Market in Dubai

Before making any investment decision, it is crucial to understand the current state of the real estate market in Dubai, particularly for off-plan real estate Dubai. This ensures informed choices are made based on market trends and conditions. Over the past few years, the city has witnessed a steady growth in property prices, particularly in sought-after areas.

This upward trend largely attributes to the continuous development and expansion of infrastructure projects, tourist attractions, and business opportunities. Additionally, this proactive approach underscores the city’s commitment to growth and innovation, attracting investors from around the globe.

Looking ahead, experts predict that the real estate market in Dubai will remain robust, presenting ample opportunities for investors. The city’s strategic geographic location, favorable tax system, and cosmopolitan lifestyle continue to attract local and international buyers alike.

One of the key factors driving the real estate market in Dubai is the government’s commitment to creating a business-friendly environment. The city offers freehold ownership in designated areas, allowing foreigners to own property outright. This has significantly boosted investor confidence and attracted a diverse range of buyers from around the globe.

Additionally, Dubai’s real estate market actively earns recognition for its innovative architectural designs and luxurious amenities. This reputation not only showcases the city’s commitment to excellence but also entices both local and international investors.

From iconic skyscrapers like the Burj Khalifa to waterfront developments such as Palm Jumeirah, the city actively offers a unique blend of modernity and opulence for off-plan developments in Dubai. These distinctive features not only enhance the overall appeal of the properties but also contribute to the city’s reputation as a global hub for luxury living in Dubai

Steps to Buying an Off Plan Property in Dubai

Before buying an off-plan property, it is important to approach the process methodically. Here are the key steps involved:

Step 1: Researching Potential Properties

Start by conducting thorough market research and identifying potential developments that align with your investment goals. You’ll need to consider factors such as

- Location

- Developer reputation

- Project timeline

- Amenities offered

- Payment plan

Consulting with a trusted real estate agent can be invaluable in this stage, as they can provide valuable insights and guide you towards the most suitable options. To get started, you can use Viewit!

Delving deeper into the research phase, it’s essential to analyze market trends and future growth projections in Dubai’s real estate sector. Understanding the demand-supply dynamics and upcoming infrastructure projects can give you a competitive edge in selecting a property that not only meets your current needs but also offers long-term appreciation potential.

Step 2: Legal Considerations for Off Plan Property

Prior to making any financial commitments, it is crucial to ensure that all legal aspects are in order. Verify the developer’s track record first. Nakheel, Emaar, and Sobha, are some household name with great track records.

You should also check relevant permits and approvals, and carefully review the sales and purchase agreement. Seeking legal advice is highly recommended to safeguard your interests throughout the entire process.

Furthermore, it’s important to familiarize yourself with Dubai’s real estate regulations and laws governing off-plan purchases. Understanding your rights as a buyer and the developer’s obligations can help you navigate potential challenges and protect your investment in the dynamic property market of Dubai. You can read about buying a property legally in Dubai here.

Step 3: Financing Your Off Plan Property Purchase

Once you have identified your desired property and conducted the necessary due diligence, it’s time to secure your finances. Dubai offers various financing options, including mortgages and bank loans. Evaluate different lenders to find the most competitive rates and favorable terms. Keep in mind that most developers require a down payment, typically ranging from 10% to 30% of the property value.

Additionally, consider exploring alternative financing methods such as developer payment plans or Islamic financing options that comply with Sharia principles. Understanding the financial implications and structuring your payments effectively can enhance your buying experience and ensure a smooth transaction process.

Costs of Buying an Off-Plan Property

Similar to buying a ready property, you will need to pay a 4% property registration fee and AED 3,000 Oqood registration fee. This amount will be paid directly to Dubai Land Department.

Risks and Challenges of Off-Plan Property Investment

While investing in off-plan properties can be rewarding, it is important to acknowledge and mitigate the associated risks. Here are some potential risks you will need to be aware of:

The uncertainty of construction timelines and potential delays is one such challenge. Go with reputed developers known for timely delivery to minimize the risk of extended completion periods.

Be mindful of the legal aspects involved in off-plan property purchases. Understanding the terms and conditions of the sales agreement, payment schedules, and potential penalties for delays or cancellations is crucial. Seeking legal counsel to review contracts can provide added protection and clarity in navigating the legal complexities of such investments.

Another risk to consider is market fluctuations. Various factors such as economic conditions, government policies, and geopolitical events can actively influence property prices, both in Dubai and globally. Furthermore, investors closely monitor these dynamics to make informed decisions and adapt their strategies accordingly..

Assess the potential impact of oversupply in the market. An oversaturated market can lead to decreased rental yields and property values. Research the supply and demand dynamics in the specific location of the off-plan property. This will give you insights into future market trends and potential risks associated with oversupply.

Making the Most of Your Off Plan Property Investment

Now that you have successfully purchased your off-plan property, it’s time to maximize your returns. There are 2 main strategies you can employ to ensure a successful investment:

Maximizing Returns on Your Investment

Consider renting out your property once the construction is completed. Dubai’s rental market remains strong, and by generating a steady rental income, you can offset holding costs and potentially achieve positive cash flow. You can list your property on embayt to gain consistent returns.

Furthermore, when it comes to renting out your property, it’s important to consider the target market. Dubai is a diverse city with a large expatriate population. Understanding the preferences and needs of potential tenants can help you tailor your property to attract the right clientele. Whether it’s providing furnished apartments for short-term rentals or offering family-friendly amenities for long-term tenants, catering to the demands of the market can significantly increase your rental income.

Long-Term Strategies for Off Plan Property Investment

Investing in off-plan properties can offer long-term benefits. As Dubai continues its upward trajectory, the value of your property is likely to appreciate. Patience and a long-term investment horizon will allow you to reap the full benefits of your investment. Monitor the market closely and consider selling when you believe the timing is right to cash in on potential capital gains.

Moreover, staying updated on the latest developments and infrastructure projects in Dubai can give you an edge in the real estate market. The city actively evolves, developing new attractions, business districts, and transportation networks. Being aware of these developments can help you identify areas with high growth potential, allowing you to make strategic investments that yield substantial returns in the future.

Closing Thoughts

By understanding the nuances of off-plan property investment, conducting thorough research, and mitigating risks, you can make a sound investment decision that aligns with your financial goals. Remember, every investment carries inherent risks, but with careful planning, the potential rewards can be significant in Dubai’s dynamic real estate maret.

Ready to explore off-plan investment opportunities in Dubai? Contact Embayt Real Estate today to discover lucrative off-plan projects and start building your investment portfolio! Click here to visit our website.